Wine takes a Tumble in BC

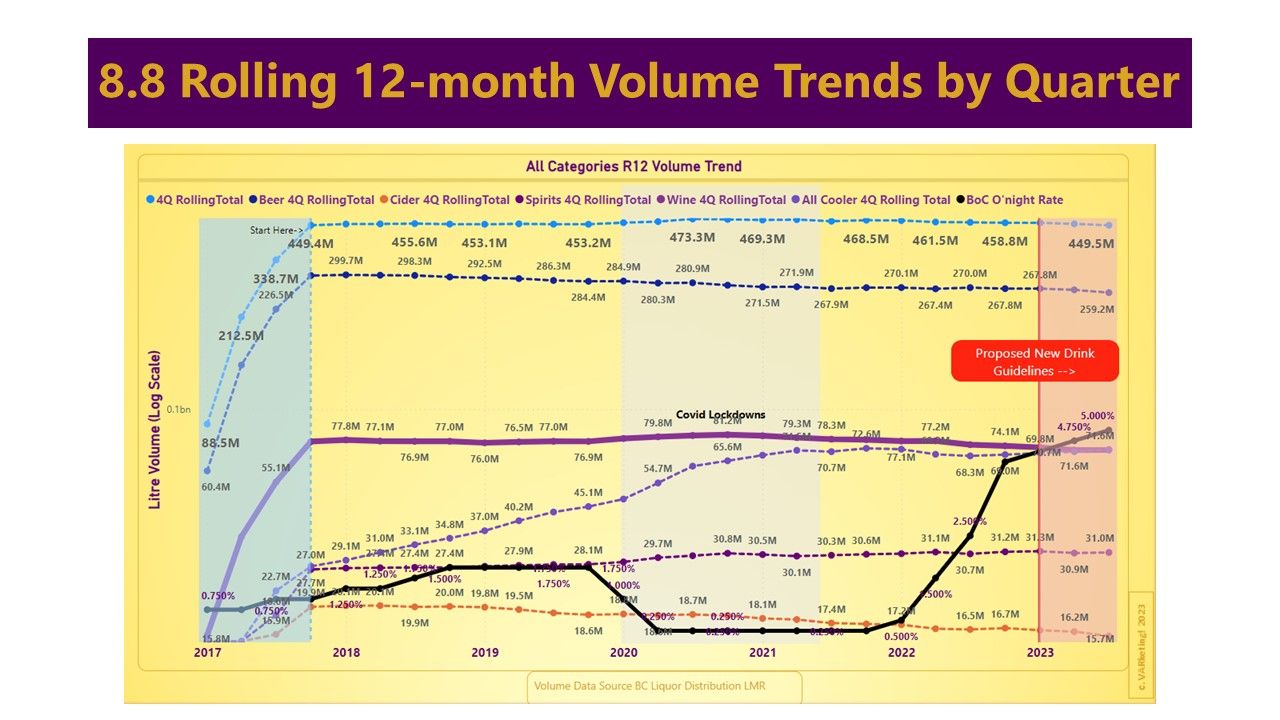

On a Rolling 12 basis, in the quarter ending September 30, 2023 the total Cooler volume (Coolers include spritzers, seltzers, RTDs etc.) just overtook wine volume for the first time.

Data is compiled from the quarterly Liquor Market Review (LMR) published by BC Liquor Distribution Branch. Data in this report is subject to revision each quarter so does not agree with the published data in the Annual Service Plan Report for the fiscal year, albeit the overall difference is <0.5%.

1. Data is for all major categories, sub-categories may move in opposite directions to the overall trend. BC's population has grown c. 10% since 2017 so per capita consumption is well down even if all-category volume is level with 2017.

2. Downtrends in beer, cider, and wine categories all started before the proposed drink guidelines were published at the beginning of 2023. Trends to low and zero alcohol beverages pre-date clearly emerged in 2022.

3. The black line shows the Bank of Canada overnight interest rate at the end of each quarter. BC's "All Item" cost of living index has escalated from 126.1 at the end of 2017 to 152.6 in October 2023 - an increase of 21%. While recession resistant, alcohol is not immune to the significant impacts on the consumer's ability to spend. In the near term, I believe economic factors are the primary drivers of the overall downtrend so far, but that the general trend towards lower alcohol consumption (exacerbated by the proposed 2023 consumption guidelines) and legal availability of cannabis based products represents a clear and present danger to all BC craft beer, cider, spirit, and wine manufacturers and their supply chain partners.

4. The combined R12 volume of beer and coolers at 2023Q3 is slightly higher than their combined total at 2017Q4.

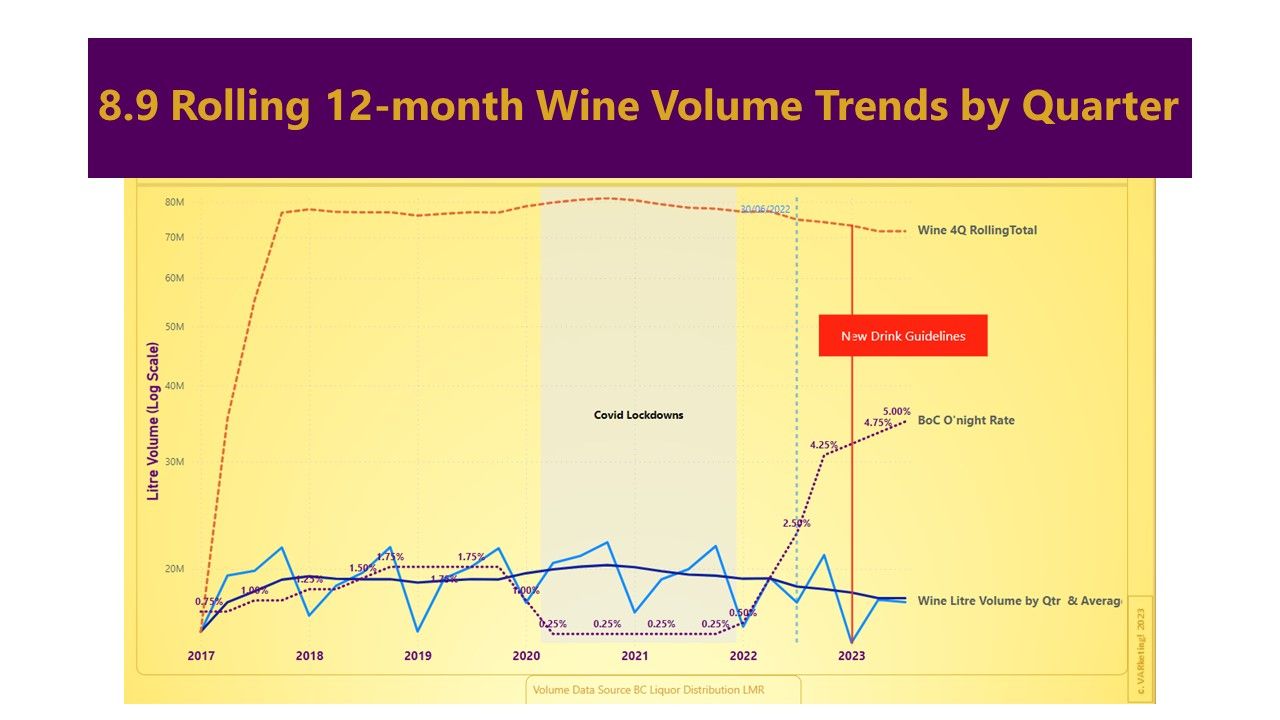

5. Wine includes all Imports, ICB and 100% BC wine. Both calendar 2022 and 2023 Q3 (Sept 30) broke down from the historical pattern of increases over Q2. Apart from likely consumer and demographic influences, the declining trend on wine consumption started as wine consumption dropped below 2019 in 2022Q3 as interest rates accelerated upwards (vertical blue dashed line) and general inflation started to hit consumers.

6. For readers not familiar with the BC wine market, the LMR classifies both wine imported in bulk but bottled in BC (known as ICB) and the products from the local industry as "BC". Genuine BC wine made from grapes grown in the Province is largely regulated and sold as "VQA" to assure origin. The VQA designation can only be applied to certain formats - most typically glass 375mL, 750mL, and 1.5mL or larger. A BC winery may selectively opt in to the VQA system for glass bottled wine and may also produce alongside it a 100% BC wine in formats that do not qualify for the VQA moniker, e.g. 250mL cans, 3L boxes etc. The 100% but not VQA category accounts for about 14% of the total volume of genuine BC wine.

The top chart below shows the market share versus imports for all wines classed as "BC" in the LMR by Quarter between 2020 and September 30 2023. The bottom chart shows the breakdown between the various categories of "BC" over three calendar years 2020-2022. Genuine 100% BC grape wine in red, white, and rose table wines plus sparkling in all formats has garnered an overall market share of 22%, 23% and 23% in 2020-2022 respectively. 95% of BC wine is sold in 750mL format. Within this format category there are many price and variety segments where genuine BC wine holds more than, and sometimes much more than, 50% market share. For more information on this please contact me as we have detailed data in the current #BCWine2022 report.

The market share spike up in 2022Q3 is associated with the LDB strike as BC wineries were able to maintain direct delivery avoiding LDB warehouses.

The BC wine industry will face many challenges to operate in a declining wine market caused by economic conditions, consumer trends, demographics, health policy, COVID, tourism, wildfires, the "Great Freeze" of 2022, changes in Government policy - to name just a few. The BC industry has added a lot of new wineries in the past 6 years and now faces a potential shortage of grapes over the medium term (4-7 years). Perhaps there is a measure of cold comfort that the "Great Freeze" event may looked back on as fortuitous in restricting supply in a time of lower demand, although this could be concomitant with significant industry rethinking and restructuring.