BC Wine Industry through the lens of Market Share

This post adds commentary for a reader who was not present at the 30 minute presentation given at the Fortify conference in Penticton November 14, 2022.

The goal of the presentation was to identify strengths (and concomitant risks), weaknesses and potential opportunities through the lens of market share data based on 2021 in sales by format (e.g. 750mL bottle, 3L box etc.), volume in 9L cases, price range and wine type/category all in the context of its home BC market.

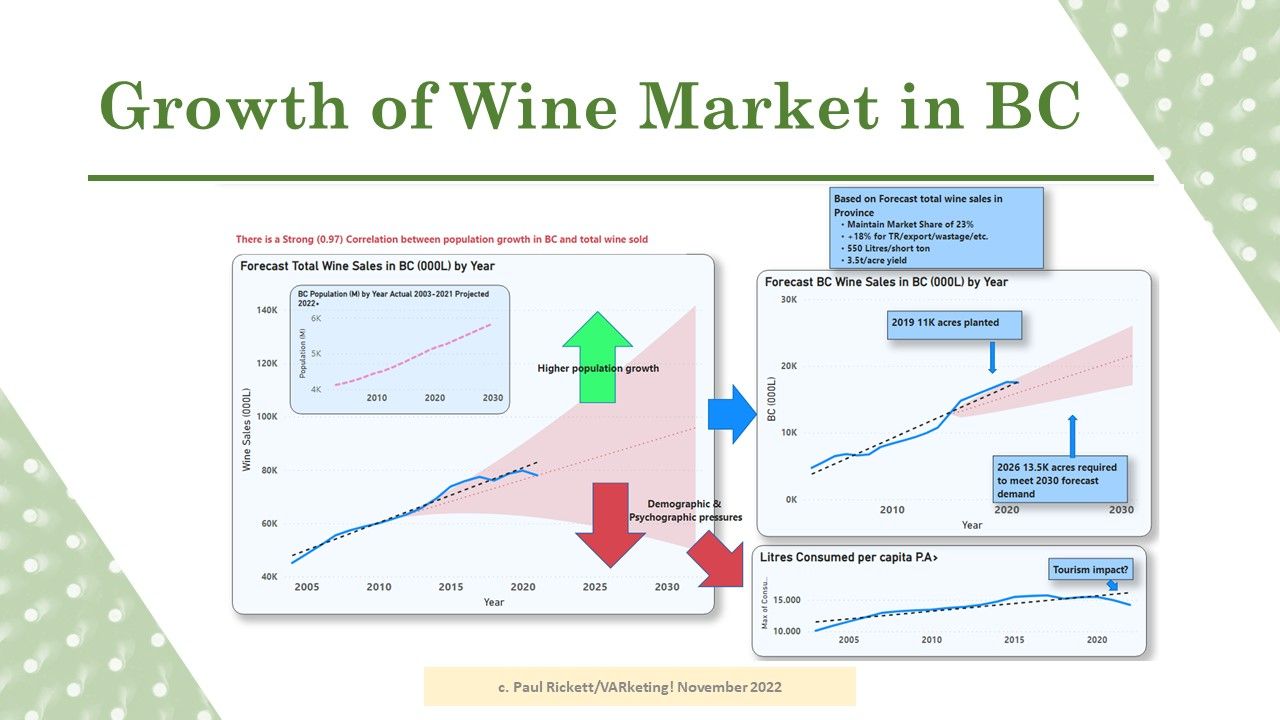

The first two slides give a very broad overview of the larger market trends of wine sales in BC within which the BC wine industry is a significant factor.

The opening slide illustrated the macro-BC wine market from 2004 projected out to 2030. The talk only focused on the left hand image.

The blue line represents actual total annual litre sales in BC, black dotted line the trend and red dotted line the forecast. There is a very strong correlation between population and volume growth. All other things being equal BC's projected population expansion supports the volume projection into the future. This is good news for BC wineries. The industry risk of the projection is represented by the down arrow. Most specifically whether wine will be as much the beverage of choice in the upcoming demographic segments as it was to the generations preceding.

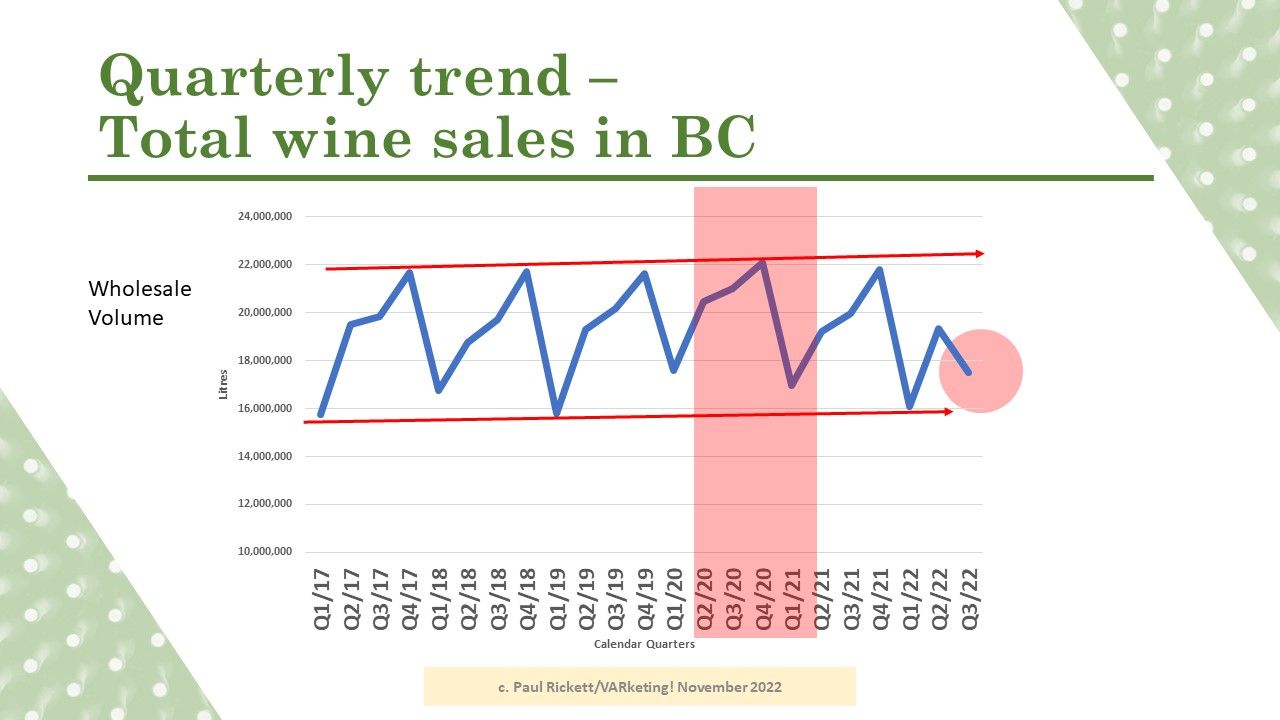

The red column was the immediate COVID period covering lockdowns etc. However total wine sales in BC grew. No doubt there was an increase in personal wine consumption in the period however what really made the difference was that BC residents stayed home rather than traveled outside the Province. In normal years inbound out-of-Province tourism has offset the outflow of BC residents. Internal and external Tourism is a vital component, however, as it generally drives direct sales, gains wine club memberships and evangelises the BC brand beyond our border.

The red circle in the last quarter shows a counter-cyclical movement caused by the LDB strike, which restricted import wine flows - to BC wine's advantage as a substitute source via direct delivery. Some of this volume will not be made up in Q4 so overall calendar 2021 will be relatively flat overall.

The vast majority of BC wine produced is sold in BC. Most wineries are situated in geographic clusters easily reached from all major population centres. BC is a highly regarded place to visit in global terms for its natural beauty. The industry is very dependent on the BC resident and tourist consumer.

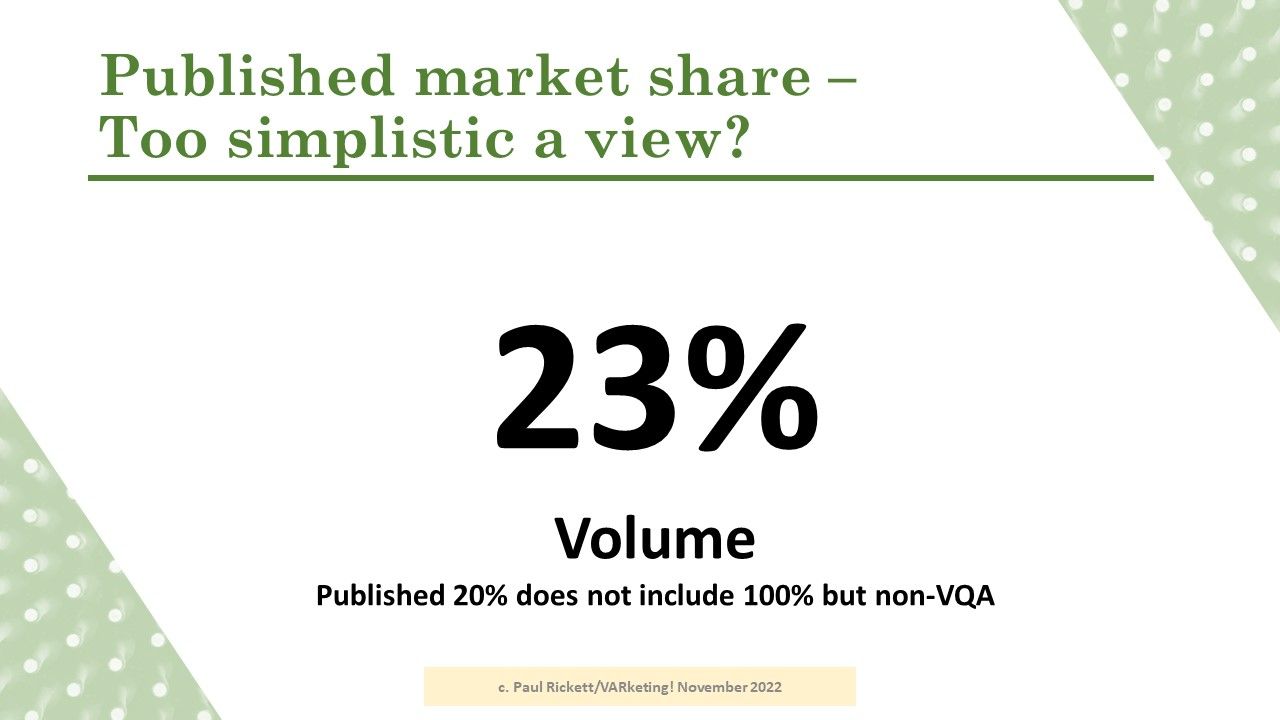

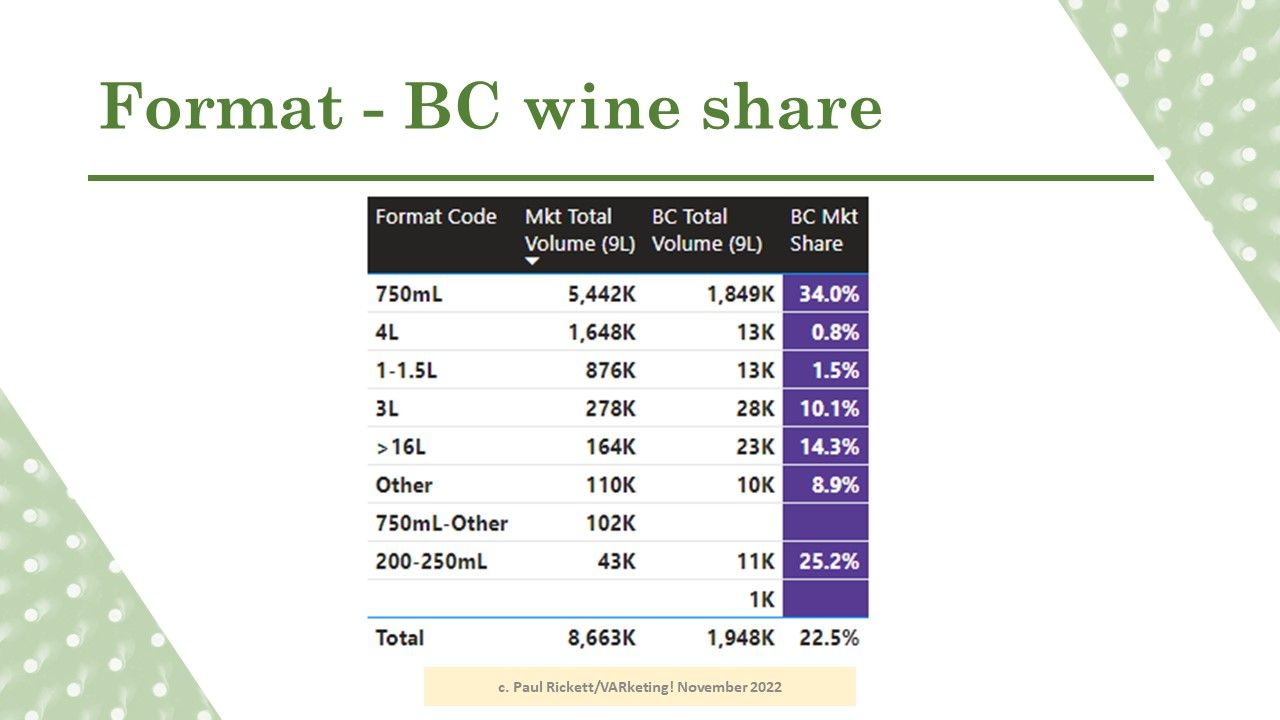

The industry trade association regularly publishes data showing BC has a ~20% market share of total wine sales in the Province. This is arithmetically correct but only refers to VQA wine. Not all wineries participate in the VQA program. Even wineries whose volume products are generally VQA also produce 100% BC wine that does not qualify for VQA because it is sold in a non-approved format (like a 3L box) or have wines that they choose not register to VQA. When these are factored in the actual market share is 22.5%. This has risen from 20% in 2017.

The 20% share is often viewed as a sign of weakness as other countries/regions have a far higher domestic market share. But if 80% of production gains only 20% do we have the acreage/yield to support a significantly higher overall share of the market? There isn't a simple answer, certainly there isn't enough acreage but yields could offset that periodically. Also in comparison to other regions the BC wine industry does not produce wine in volume across all the spectra of format/price/wine type that other regions do - the data following will demonstrate that.

As the 'home' wine market expands, the current and forecast production is barely enough to sustain current overall share into the projected future volume, let alone expand it. However, if the negative global trends on wine consumption develop in BC then BC's wine industry will need to be far more serious about overcoming the barriers its faces in developing external markets to use the surplus and maintain growth.

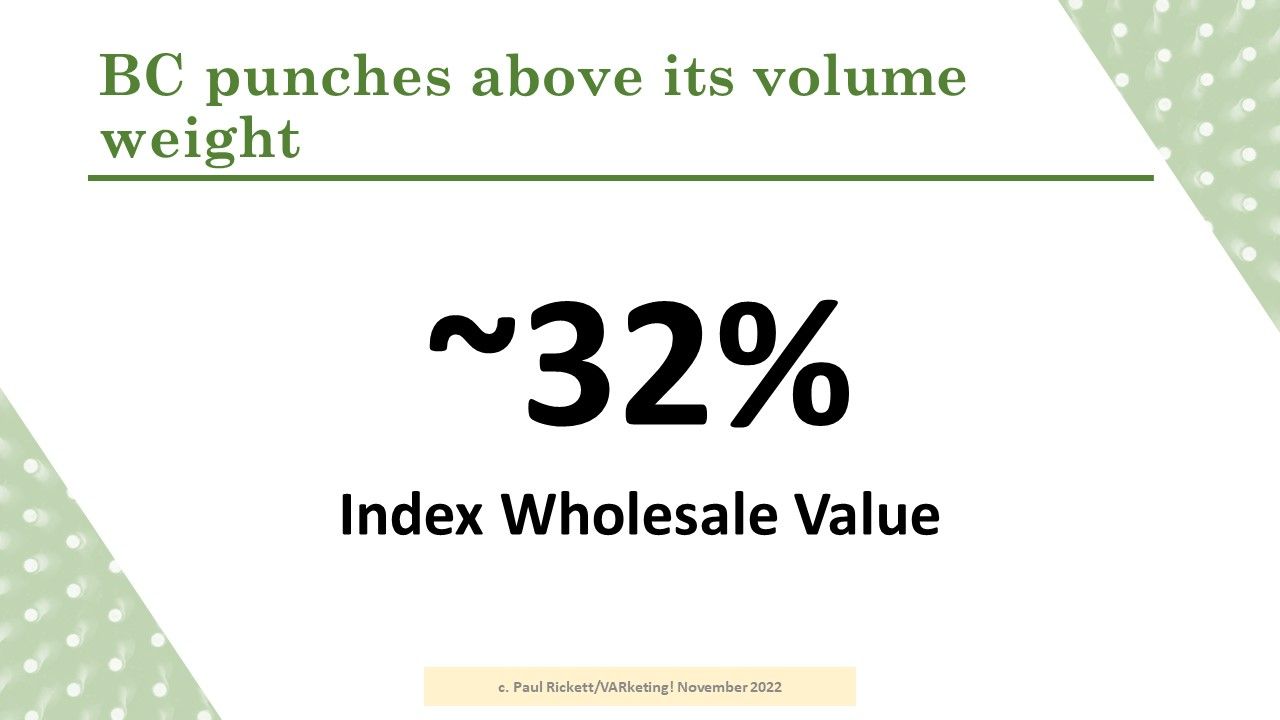

The good news is that 100% BC wine is that its price points are higher so even with only 20% of volume it accounts for 32% of wholesale value across all formats and price bands.

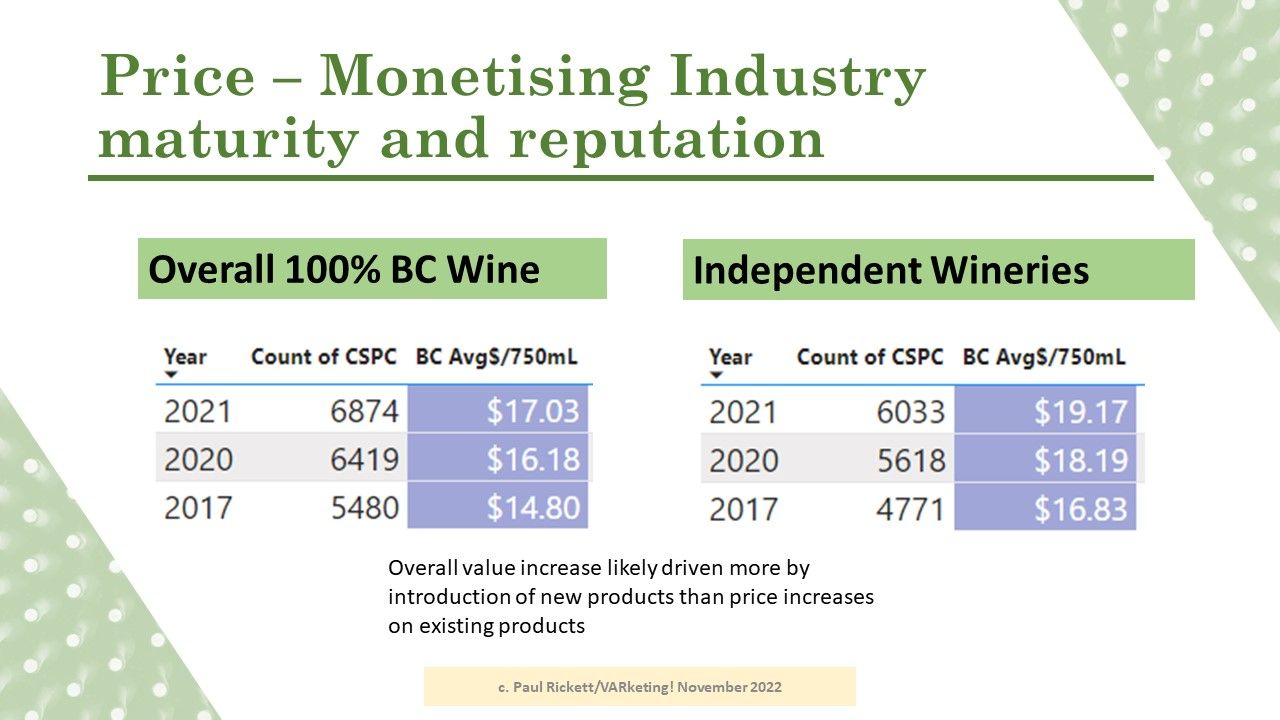

As the BC wine industry has matured it has received strong support from BC consumers and visitors. Between 2017 and 2021, years with low inflation, it has successfully increased the overall average wholesale price by improving quality (value and reputation) and introduction of more premium wines.

The chart shows the overall average per 750mL bottle. Independent Wineries are those not wholly-owned by the 3 large combines operating in the market (Arterra, Mark Anthony and Peller). Incidentally, Independent Wineries account for ~55% share of total 100% BC wine 750mL sales in the Province.

Having set the broader market stage, the following slides will show that in many segments BC has a commanding market share that has implications for individual winery strategy, especially if the winery's goal is to scale up.

Some answers to the question posed in the title of the slide are given at the end of the presentation but can be generally stated as "It depends...".

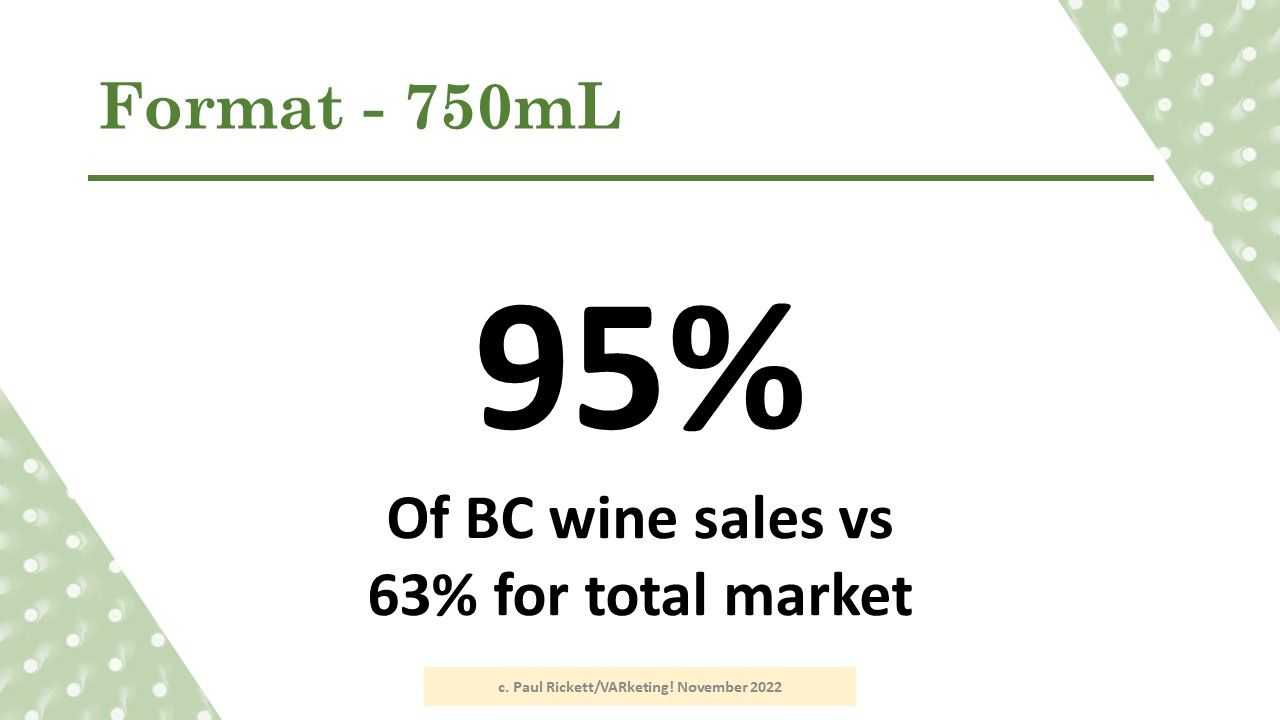

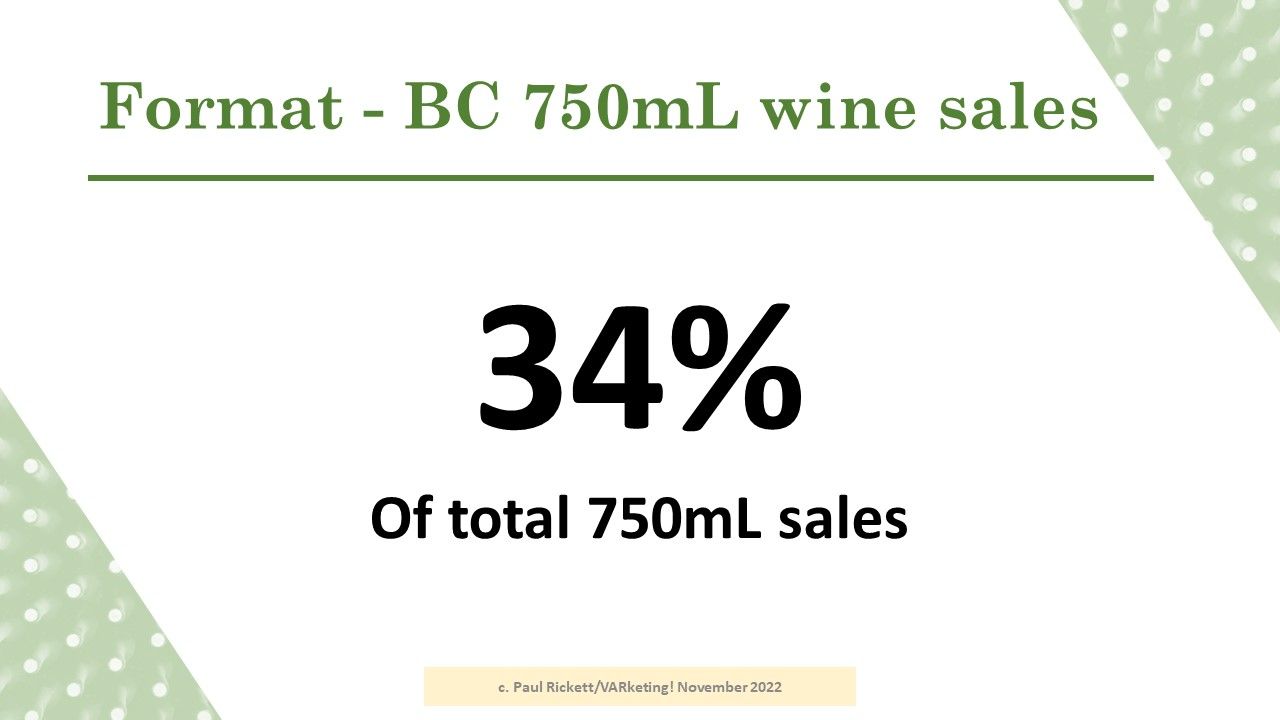

95% of BC wine sales are sold in 750mL glass format but only 63% of the total litre volume is delivered to consumers in that format. So in the ONLY market segment we really address from a format perspective 2021 market share jumps to 34%, up from 29% in 2017. The 95/63 ratio has been really consistent since 2017 with a slight change in 2020 due to COVID.

While there is undoubtedly opportunity to increase market share in other formats, the challenge is that there has been an insufficient and inconsistent supply of grapes at the right price to compete and hold market share against the entrenched competition. There is no real point in diverting grapes from 750mL format if the revenue and profit from so doing is less, unless there is grape supply above that required for 750mL - which the last few vintages have not delivered.

Given the dominance of 750mL format all the following slides address just this format.

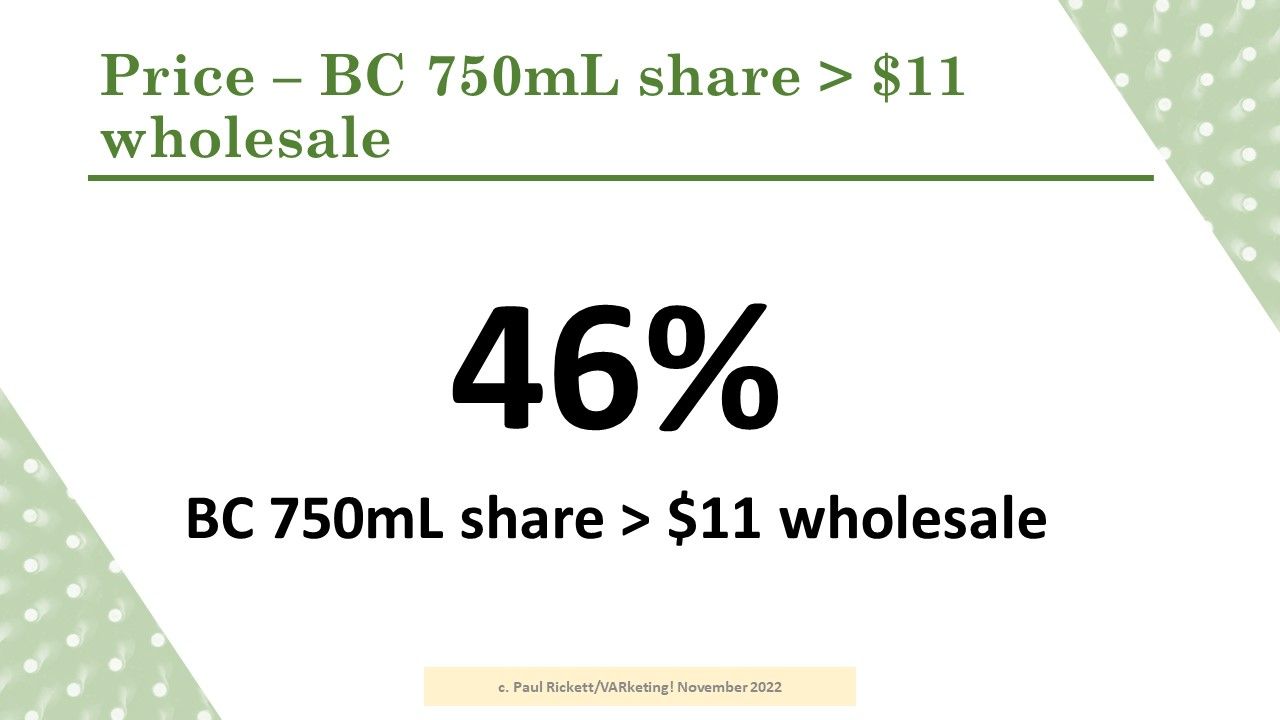

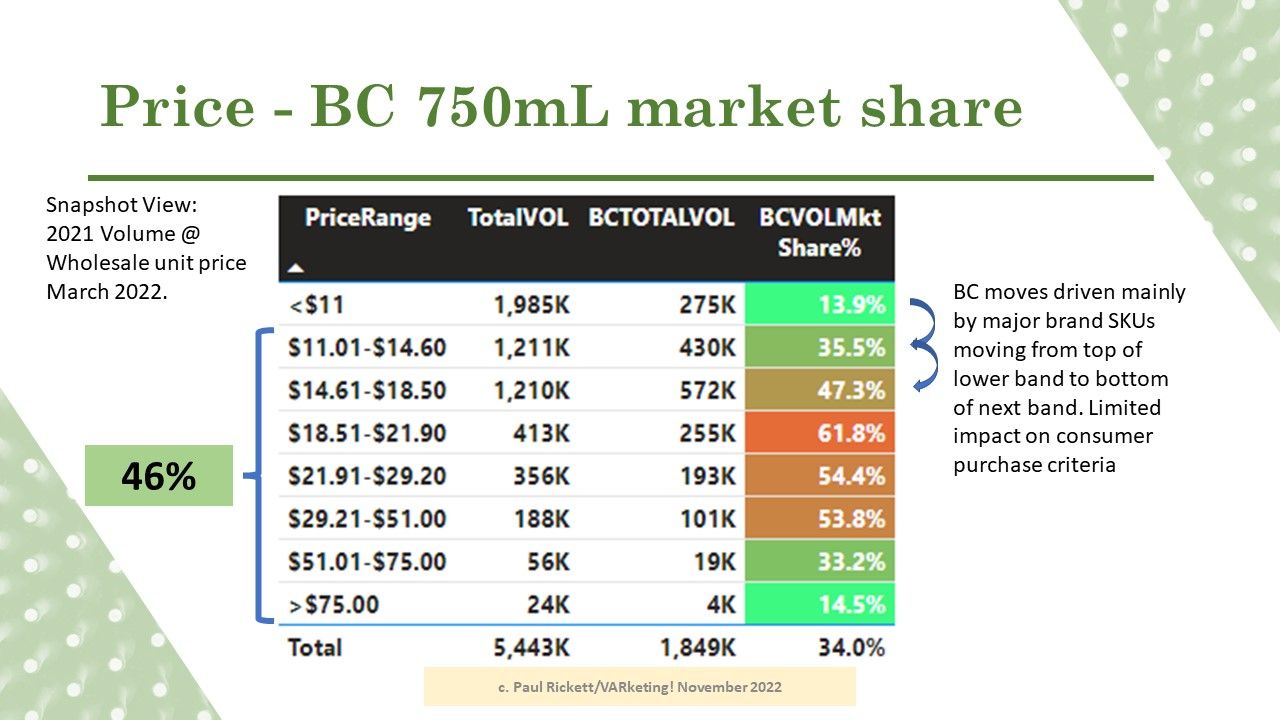

Given input costs, regional, and scale limitations, BC cannot compete on cost with large volume wine producing regions and therefore producing 100% BC wine in the <$11 price segment in volume is currently not feasible for most.

The chart above shows market share by wholesale price range. The band sizes were originally developed in 2017 to reflect consumer price flexibility at retail where each band was very approximately half the size of the one above. Price is, however, a continuum and moving from the very top of one band into the very bottom of the next has limited impact on what the consumer pays.

The chart shows 2021 volumes repriced at wholesale ruling end of March 2022. Of note, the pattern shown is significantly different than the historic pattern and especially from the same chart at December 31 2021 when the BC market share in the bands from $18.51-$51 all ranged in the 60%+. The data in this matrix tends to be more volatile as, for instance, large LTOs on high volume products (not uncommon with high volume US wines) can cause temporary changes in the bands.

I believe what has driven the change between December 31 2021 (historic pattern) and end of March 2022 (chart) is that inflation-driven price increases flowed through into the market across the board. BC winery price increases have continued since then (see prior blog post on price increases). As at July 31 2022, the volume-weighted average wholesale price of a BC 750mL has risen to $17.63 (+$0.60/+3%) and will be higher by year end. This translates to an average winery direct selling price of $22-$25.

Taking all price segments above $11 wholesale, BC sells 85% of its 750mL wines in these segments resulting in a 46% market share - double the publicly quoted number.

Within that 46% however, there are price and product segments where BC has an even higher share ranging up to 95% in one case- much more comparable with other regions. The obvious risk of a high market share is just how much more is attainable given cost, wine type/style, quality, reputation etc.

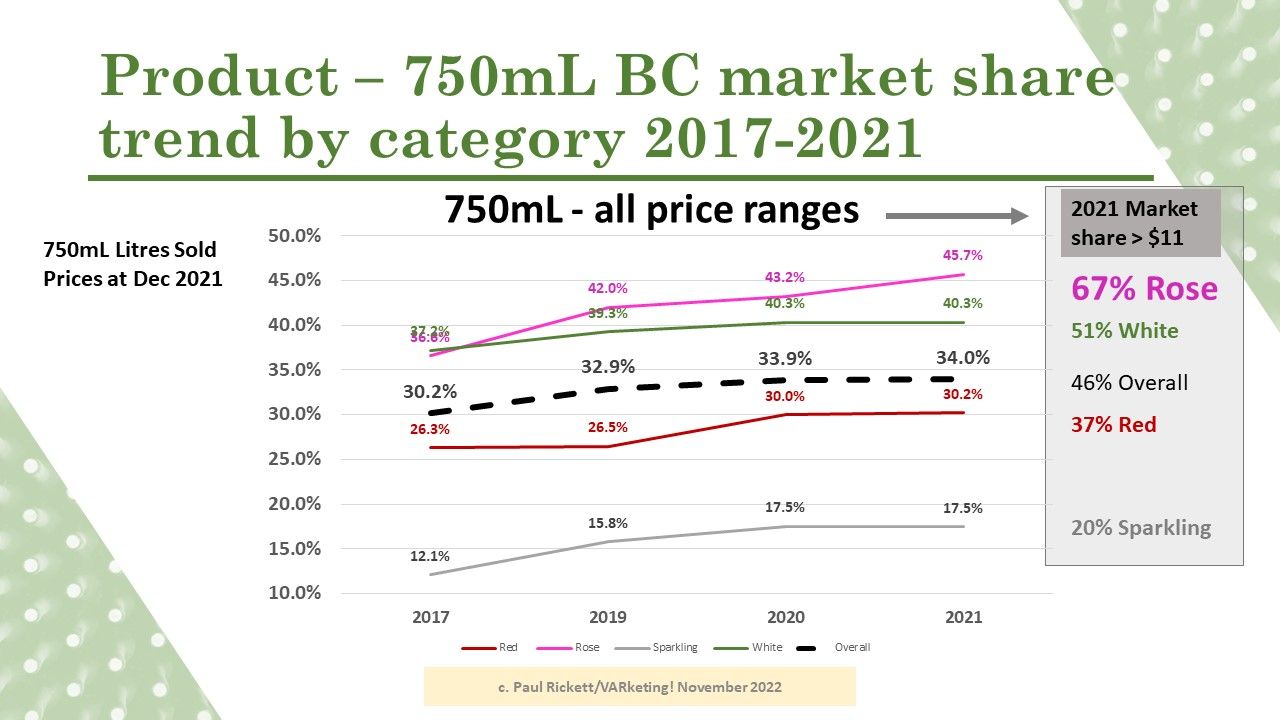

Breaking the market down by broad wine category (Red. White, Rose and Sparkling 750mL) we see that across the entire price spectrum we only underperform our overall market share in Sparkling wines. Note how the 46% >$11 wholesale morphs by product category with the standout 67% market share for Rose.

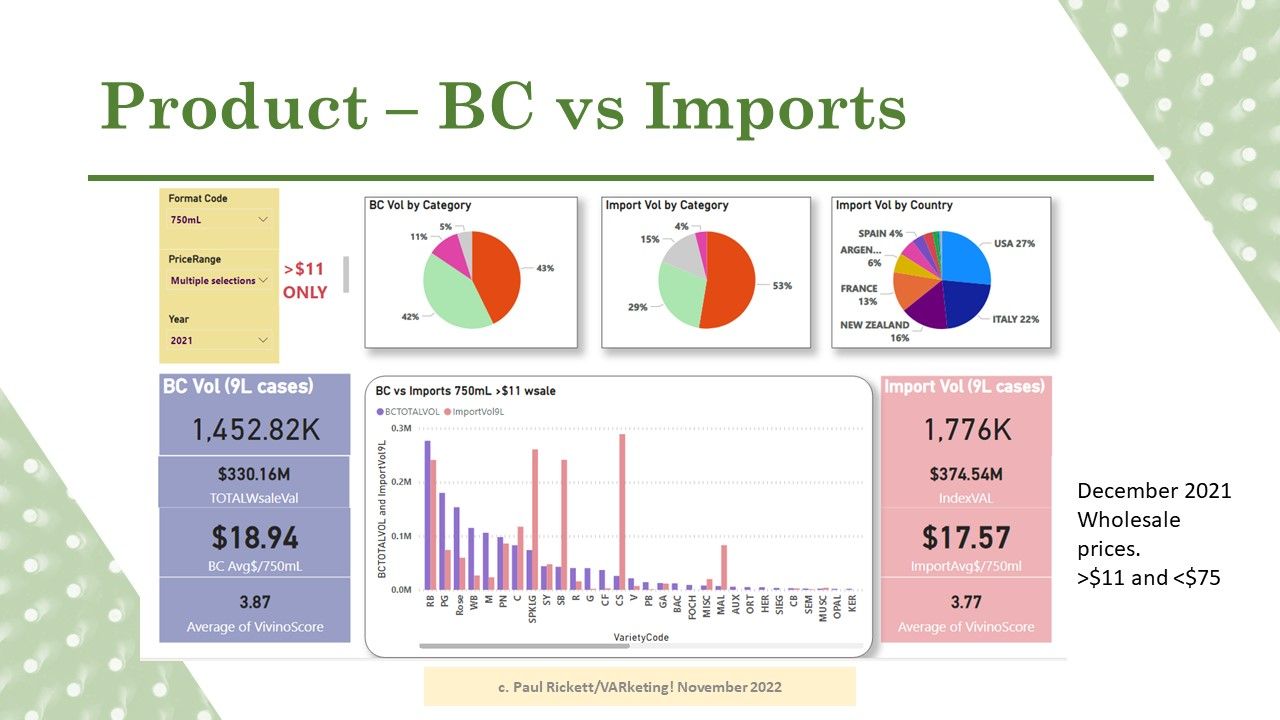

The wine market in BC has three major categories of supply. ICB (imported bulk wine bottled here), Imports and 100% BC wine. ICB wines are significantly represented in the <$11 750mL price category and especially in the larger formats. Generally ICB fulfills market segment demand that 100% BC wine cannot. In the >$11 market the main competitors are Imports.

In the >$11 segments, 100% BC wine sells 80 bottles of 750mL wine to every 100 Imported. Several points stand out:

- In many product categories BC outsells imports. Of the five visible categories above where Imports are substantially ahead of BC, one is Malbec - a very popular category in which we have little planted. The other four are best considered in the next slide.

- BC consumers are enthusiastic industry supporters so the overall price premium looks entirely reasonable. In fact in some price/wine sub-segments, BC sells at a discount to imports which, hopefully, speaks to the industry's future ability to cover cost-induced price increases without losing volume.

- Vivino score show that BC's consumer reputation supports the overall price premium.

The final segmentation offered at the presentation pulls together the BC market share by wine type (as sold, not as grown) by wholesale price segment.

- Green circles represent <50% market share

- Yellow Triangles <66% market share

- Red Diamonds >66% market share

- Total columns show the ratio of BC wine 750mL sales to Import sales - for instance, for wine sold as a Gewurztraminer BC outsells Imports 21:1 or the equivalent of an overall 95% market share!

There are lots of triangles and diamonds indicating that BC wine's main competition is now more often other BC wineries rather than imports. The four columns with largely green circles represent significant potential but to address these the BC wine industry might have to:

- Change consumer preference from strongly established competing styles.

- Alternately, change its wine style to reflect what the consumer wants to buy.

- Overcome significant market entrenchment of popular global wine styles/regions and their price points, and/or

- Produce more wine to compete at lower price points and in other formats.

All of the above are long term strategic industry positioning rather than tactical actions and may be impractical/undesirable. However, these issues also put a cap on what BC industry can reasonably expect in overall market share growth. if production increases (2022's vintage yield is the highest in some years), the BC market may not be able to absorb what is available in some categories so increased effort to develop markets outside of BC becomes really important.

BC wineries have added an average 20 new brands p.a. since 2016 and the trend continues in 2022. Most of these brands are new single-branded wineries. These dilute the visitor traffic to existing tasting rooms in the area so even if visitor traffic to a region increases it will be spread over more places to visit. In a highly competitive market, brand and location marketing, product reputation and channel strategy become even more important. Despite the entry of many new brands since 2016, brands that were in existence then still account for 93% of all BC wine sales.

Back in 2018 at a Fortify presentation I highlighted the basic business problem all wineries face.

High market share can further compound this problem.

In this presentation we have gone from a 20% overall market share to an extreme of 95% in one segment. The data shows that BC wine - in the segments that it is structurally able to play in - does much better than the publicly quoted figures.

Market share snapshots like this always need to be used in context and carefully. High market shares do not axiomatically translate into limited opportunity if the market is growing even faster or one has a very competitive product. This has certainly been the case for say, BC rose which has maintained its high market share in the >$11 segment since at least 2017 even as the overall market for this category expanded by 66% between 2017 and 2021. High market segment shares may also indicate an opportunity to raise prices faster than otherwise. Regardless of the extent or vector that market share is moving in there is always opportunity to capture market from BC competitors. While a rising tide has tended to lift most boats over the past few years it does not necessarily lift all those boats equally and some are still left stranded.

The other context that arises is who is the consumer of the data?

- The arithmetically correct 20-23% statistic is useful as a lobbying point with government agencies and, much less wisely, for other purposes.

- Specific format/segment/price data are inputs into the winery planning process. These inputs impact both short term plans (e.g. marketing, pricing and channel strategy) and, more importantly, longer term plans (what to plant, what to make etc.).

For the many small BC wineries who mainly sell direct there are still lots of opportunities in both the price and product matrices. Medium and larger wineries with growth plans might want to seriously consider developing a more consistent market outside of BC, especially for wines that already have a very high market share in BC, while maximising their returns within it. Every winery has different goals, capabilities and resources and for whom the data will have different implications.

The data presented in this blog comes from our business intelligence platform (Microsoft Power BI) built on an extensive database of product and industry level data with additional segmentation classes. This means it is easy to slice and dice by any set of parameters a winery needs, for instance the entire price band segmentation can be drawn differently in very little time.

I am happy to demonstrate the features and how we can provide input to your planning process in the free call above. There is a short survey response required ahead of the call.